Accompanying the City, Shaping the Foundations of the Future

The Ho Chi Minh City Finance and Investment State-owned Company (HFIC) is a 100% state-owned enterprise under the People’s Committee of Ho Chi Minh City. HFIC was established through the reorganization of the Ho Chi Minh City Investment Fund for Urban Development (HIFU).

As the core public financial institution of Ho Chi Minh City, HFIC performs the following functions:

- Mobilizing capital from both domestic and international sources;

- Providing loans and investmenting in key projects for socio-economic infrastructure development;

- Receiving and managing entrusted investment and lending activities;

- Managing state capital ownership in enterprises.

HFIC has played a pivotal role in advancing key development projects, contributing to shaping the modern urban landscape, enhancing infrastructure quality, and improving the living standards of the City's residents. HFIC’s contributions can be seen across major sectors:

- Transport infrastructure: Phu My Bridge, Saigon 2 Bridge, and Hanoi Highway Expansion;

- Education & healthcare: Ton Duc Thang University, International University (VNU-HCMC), University of Medicine and Pharmacy Hospital, Cho Ray Hospital, and Children’s Hospital No.1;

- Urban development & environment: Sawaco Water Supply System and Tan cang Hiep Phuoc Port.

HFIC currently manages a diversified portfolio of 30 investments with a total value of VND 6,545.9 billion, which includes many leading enterprises such as: CII, Cholimex, HSC, REE, Kenh Dong Water Supply, HDBank, and Eximbank, reflecting its strategic role in both public and private sector development.

In addition to its investment activities, HFIC has been assigned by the Ho Chi Minh City People’s Committee to lead the implementation of the city’s interest rate support policy under Resolution No. 09/2023/NQ-HĐND of the City's People's Council, aiming to reduce financing costs for enterprises and public institutions, and to promote sustainable economic recovery and growth.

Under the guiding principle of “Joining hands to build a prosperous city” HFIC continues to play a leading role in mobilizing, allocating, and managing financial resources that support Ho Chi Minh City’s inclusive and sustainable development.

Vision

To become a pioneering and strategic public financial institution in mobilizing capital and investing in technical infrastructure and socio-economic infrastructure development for Ho Chi Minh City.

Mission

- Preserve, grow, and optimally utilize resources entrusted by the People’s Committee of Ho Chi Minh City, especially those derived from the equitization and restructuring of state-owned enterprises.

- Mobilize investment resources to support the City’s sustainable development and enhance the quality of life for its residents.

Core Values

- Transparency

- Professionalism

- Efficiency

Public Capital – Spreading Value – Developing Ho Chi Minh City

HFIC is oriented towards becoming the key public financial institution of Ho Chi Minh City in mobilizing capital for socio-economic infrastructure development. The Company will continuously diversify its capital sources in terms of mobilization methods, instruments, and timeframes, aligning with specific project phases and needs.

Concurrently, HFIC will promote its role as a strategic investor, a pioneering investor, helping to mobilize greater participation from social and private sectors. Capital will be concentrated on the City's key sectors and priority programs. This goes hand-in-hand with fulfilling its responsibilities as the representative of state capital ownership in its affiliated enterprises, thereby preserving and developing public resources to serve the City's sustainable development.

Formation and development process

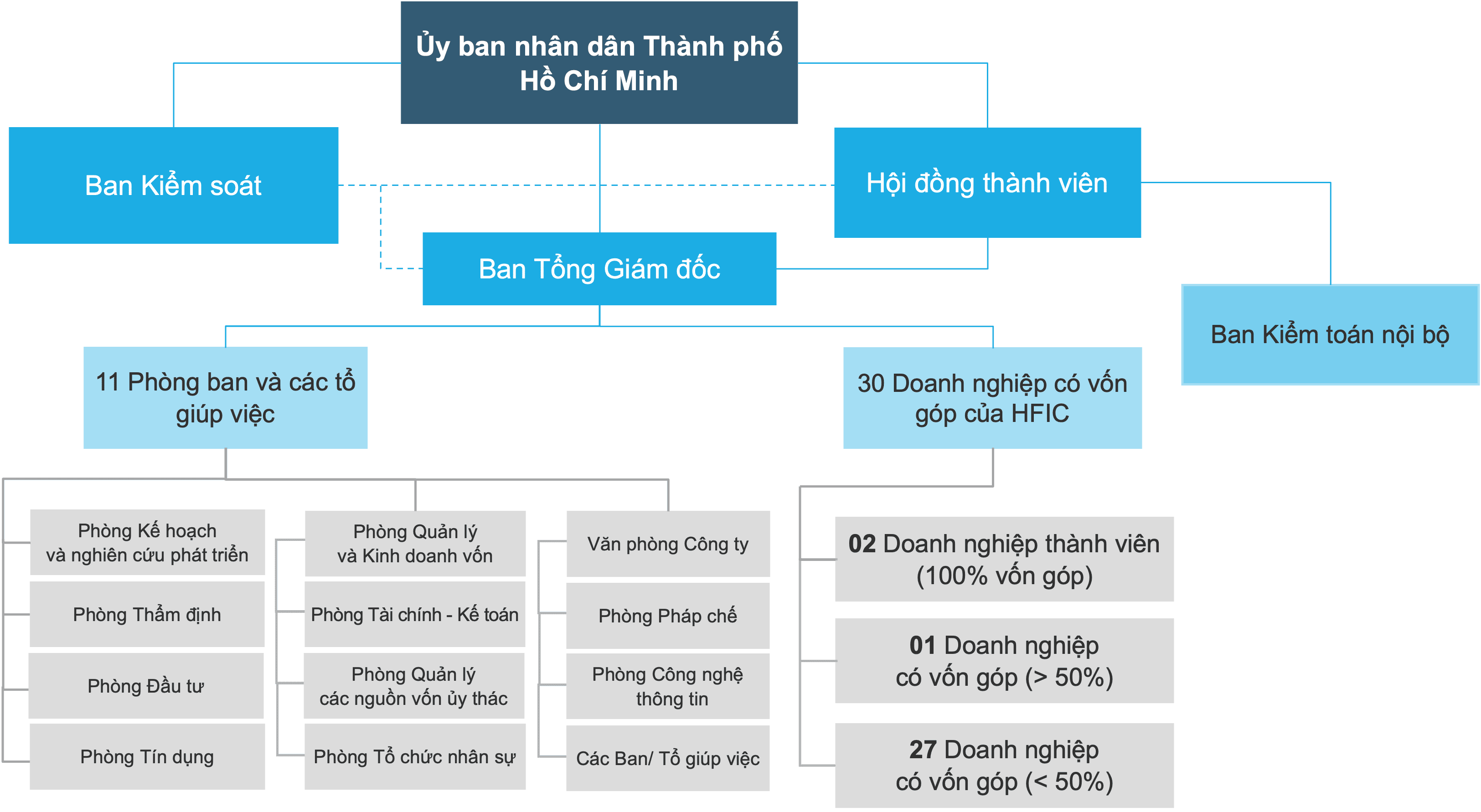

Organizational Chart

Organizational Structure

Functional departments